Get the free marketplace 1095 a online form

Get, Create, Make and Sign

Editing marketplace 1095 a online online

How to fill out marketplace 1095 a online

How to fill out printable 1095 a form?

Who needs printable 1095 a form?

Video instructions and help with filling out and completing marketplace 1095 a online

Instructions and Help about fillable 1095a form

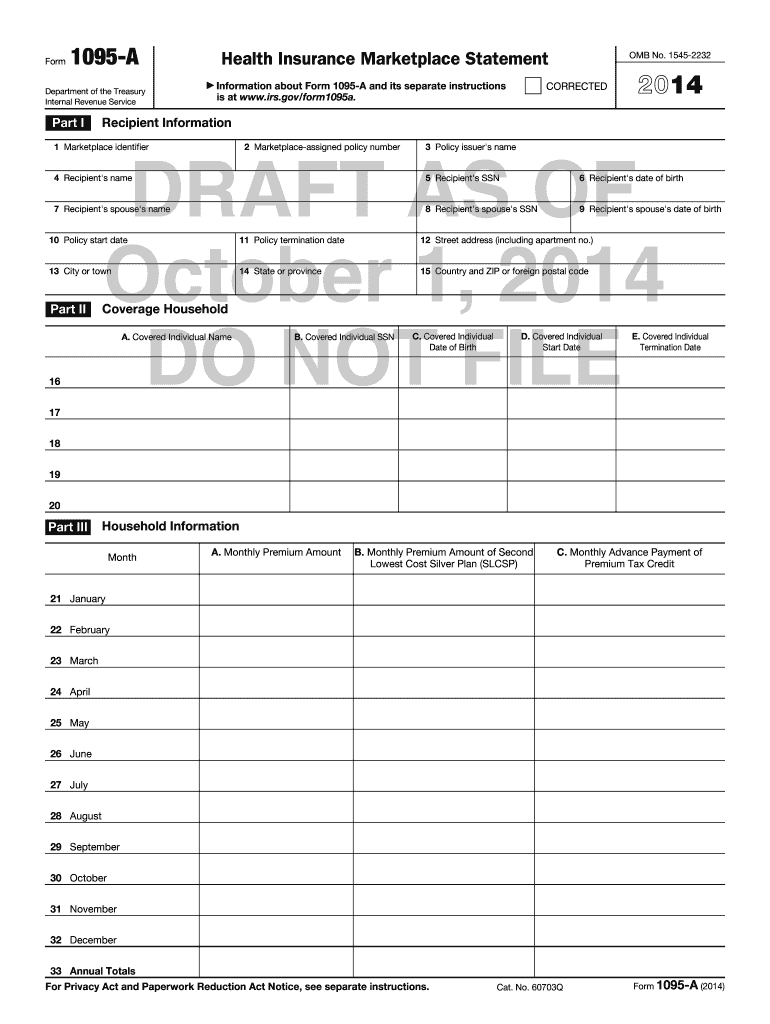

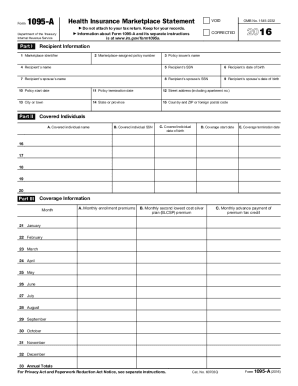

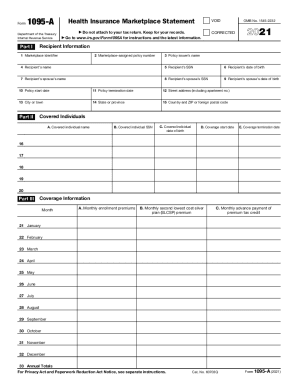

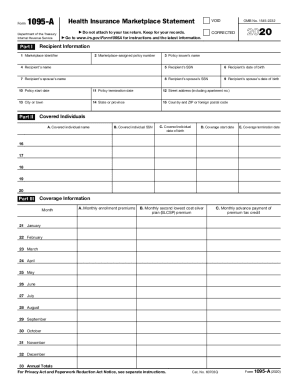

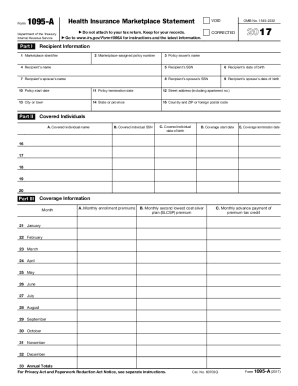

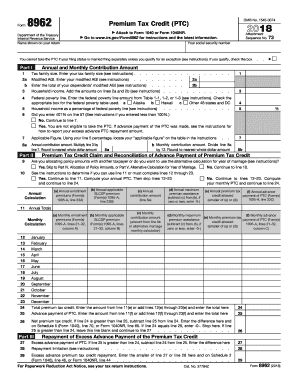

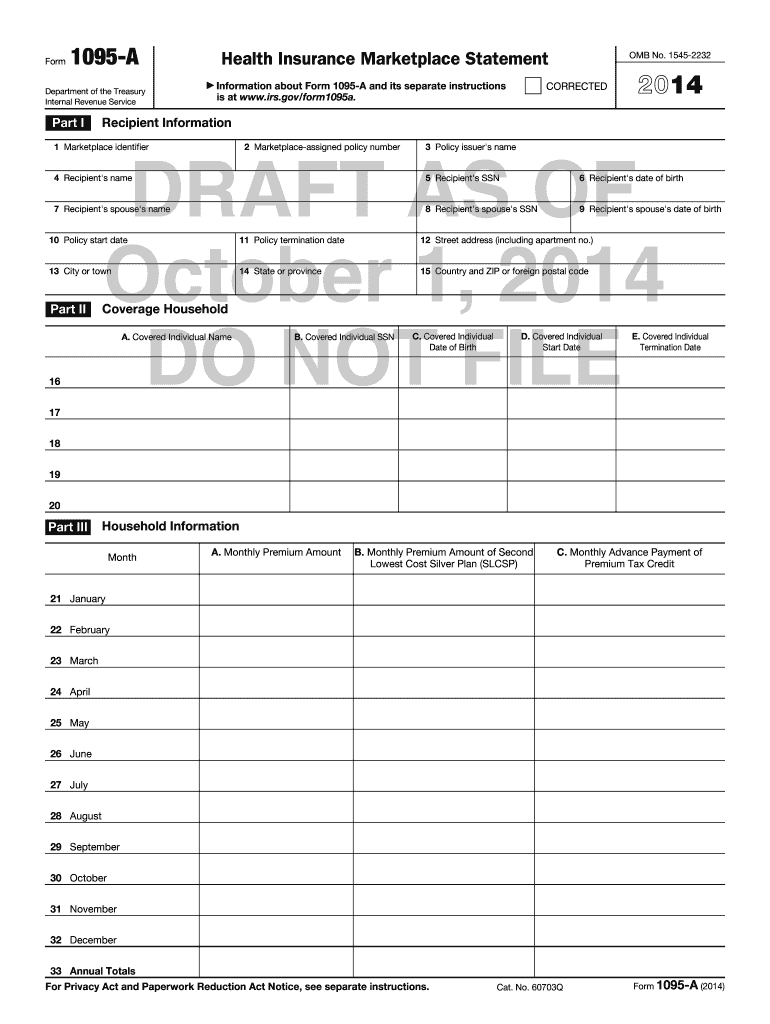

Thanks for selecting the following tax layer probe training video in this video we'll discuss form 1095-a health insurance marketplace statement we'll talk about reconciling the net premium tax credit, and we'll talk about filling out form 89-62 in the desktop software form 1095-a should be received by any person on the tax return covered by a marketplace plan the 1095-a should be issued by January 31st and taxpayers should wait to receive the 1095-a before filing their tax returns part 1 of the 1095-a reports information about you or the taxpayer the insurance company that issued the policy and the marketplace where the taxpayer enrolled in the coverage part 2 reports information about each individual who is covered under the policy this information includes the name social security number date of birth and the starting and ending dates of coverage for each covered individual while part 3 reports information about the insurance coverage that you will need to complete form 89-62 to reconcile the advance credit payments or to take the premium tax credit when the taxpayer files his or her return next we'll look at a completed fictitious 1095-a and then put the information into a tax return now the 1095-a that you see here is broken up into its parts so that we can more easily see the information contained on the form the information on the form 1095-a that's needed to complete the net premium tax credit or form 89-62 includes the following the policy number for the policy that the individual on the tax return purchased from the marketplace or the state healthcare exchange each individual covered under the policy and the months that each person and coverage and part three contains the enrollment premiums which of the amount of the premiums for the months in which any individual on the tax return was enrolled in one or more qualified health plans and this is found in part three columns an of the form 1095-a column B of this form contains the applicable second lowest cost silver plan or SLC SP that applies to the taxpayers who received the 1095 a's not necessarily the plan to which the taxpayers enrolled, but it's used to determine the net premium credit and again these SLC SP or second lowest costs silver plan amounts are found in part three column B of the form 1095-a certain 1095 a's that are issued to policyholders don't have an amount listed for the SLC SP because the taxpayer didn't request financial assistance at the time that they purchased the policy if there is no SLC SP or if no SLC SP is contained on the 1095 a marketplace website has a premium tool that can be used to determine the SLC SP if the policyholder shares this policy with an individual that is not on the same tax return as the policyholder the 1095-a will be shared with that other individual this is known as a shared policy and a shared policy allocation if the policyholder does not share the policy with a person who is not on the tax return and follow the next steps to enter a...

Fill blank 1095 a form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your marketplace 1095 a online online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.